top dog insurance policy field guide for calmer decisions

What "top" really means

From the clinic side, a top policy is less about glossy marketing and more about how predictably it pays when things get messy. Price matters, but clarity and coverage do the heavy lifting. I've watched owners wince at surprises hidden in fine print; I've also seen quiet relief when a claim just...works.

A small pause: paperwork feels distant until paws slip.

Coverage pillars worth verifying

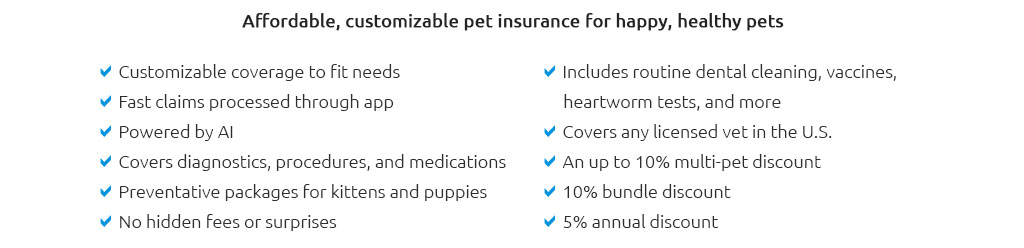

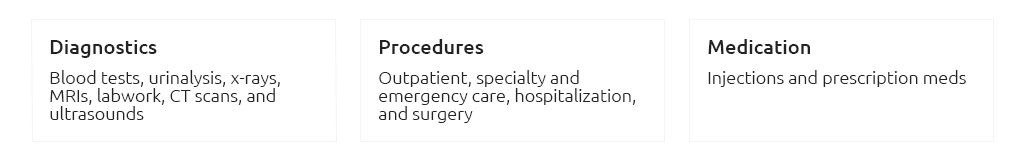

- Accident + illness: Not just broken nails - think pancreatitis, foreign body surgery, and sudden lameness.

- Hereditary/ congenital: Hip dysplasia, IVDD, cardiomyopathy; make sure there's no breed carve-out.

- Chronic conditions: Ongoing allergies, thyroid disease; check for lifetime coverage vs per-condition caps.

- Diagnostics: Advanced imaging, pathology, and exam fees - often excluded unless specified.

- Dental: Illness (stomatitis, resorptive lesions) is frequently excluded while accidents (fractures) are covered.

- Rehab and alternative care: Acupuncture, hydrotherapy, laser - great value for ortho cases if included.

- Meds and therapeutic diets: Some plans reimburse prescription food; many don't.

Field notes from practice

Saturday flyball meet - Border Collie slices a pad on rough turf. Owner opens the insurer's app by the crate, snaps the invoice, and uploads the vet notes. Deductible: $250. Reimbursement: 90%. Funds posted in three days. No drama, just care and a clean follow-through. That's what "top" has looked like in real rooms with real dogs.

Numbers that change the bill

- Deductible: Per year vs per condition shifts long-term costs.

- Reimbursement rate: 70 - 90% is common; the copay gap is bigger than it looks over a year.

- Annual limit: Five figures is comforting for surgeries; unlimited isn't always necessary but removes guesswork.

- Waiting periods: Ortho injuries often have longer waits; ask about waiver options with exams.

- Exam fee coverage: Many policies exclude it - adds up fast.

- Preexisting definitions: "Look-back" windows matter more than slogans.

Red flags and bright spots

- Red flags: Mandatory networks for emergencies, "one and done" caps on chronic issues, hereditary exclusions by breed, complicated claim portals.

- Bright spots: Direct pay to hospitals, clear formulary for meds, rehab included after orthopedic surgery, phone support that actually reads medical notes.

Budgeting and value

Match the policy to your dog's risk profile - age, breed tendencies, activity level. A young, athletic dog benefits from solid accident and ortho coverage; seniors lean on diagnostics and chronic care. Premiums rise with time; stable terms and transparent increases are worth a little extra now to avoid churn later.

Questions to ask before you buy

- Is the deductible annual or per condition, and does it reset on renewals?

- Are exam fees, rehab, and prescription diets covered or optional riders?

- How are preexisting conditions defined and for how long is the look-back?

- What are ortho waiting periods and waiver steps?

- Do you offer direct pay, and what documents speed approval?

- Any breed-specific exclusions or lower limits I should know about?

Claim flow that actually works

- Save invoices and complete medical records - history helps reviewers connect dots.

- File within 24 - 72 hours; late submissions stall.

- Answer follow-ups quickly; a single missing soap note can hold a payout.

- Track EOBs; reconcile deductibles and remaining annual limits to plan next steps.

If you self-insure

Some owners set aside a monthly amount equal to a premium in a dedicated account. It works best with discipline and a realistic emergency target (think one major surgery). Insurance, by contrast, trades certainty of premium for protection from low-probability, high-cost events. Choose the path that keeps care accessible, not stressful.

Closing guidance

Read the whole policy, not just the brochure. Ask hard questions. Pick coverage you understand on a tired Tuesday, because that's when you'll need it. A top dog insurance policy isn't flashy - it's steady, boring, and dependable right up until the moment it makes a hard day easier.